The Indian real estate market continues to evolve, with developers launching innovative projects to meet growing demand. Among the many opportunities available, one option stands out for savvy buyers and investors: Benefits of Investing in Pre-Launch Residential Properties.

Pre-launch projects are properties announced by builders before construction begins or in the very early stages. These investments often come with advantages like lower pricing, better choice of units, and high appreciation potential. But are they right for everyone? Let’s explore this in detail.

What Are Pre-Launch Residential Properties?

Pre-launch residential properties are projects introduced by developers before official sales and marketing campaigns begin. During this stage, buyers get access to exclusive deals and introductory pricing.

This early-bird window is typically offered to create buzz and generate initial funding for the project. For buyers, it represents a unique chance to lock in properties at competitive rates.

Benefits of Investing in Pre-Launch Residential Properties

Key Benefits of Investing in Pre-Launch Residential Properties

1. Lower Pricing Advantage

One of the biggest benefits of investing in pre-launch residential properties is the price factor. Developers usually offer units at 10–30% lower prices compared to post-launch rates.

- Early buyers secure cost savings.

- Pricing often increases once approvals are finalized and construction progresses.

2. Higher Appreciation Potential

Investing early can lead to significant appreciation by the time the project nears completion. For example:

- A flat booked at ₹70 lakhs in the pre-launch stage may be worth ₹90–95 lakhs post-possession.

- This makes it attractive for both investors and end-users seeking wealth growth.

3. Wider Choice of Units

At pre-launch, buyers enjoy first pick of the inventory:

- Preferred floor levels.

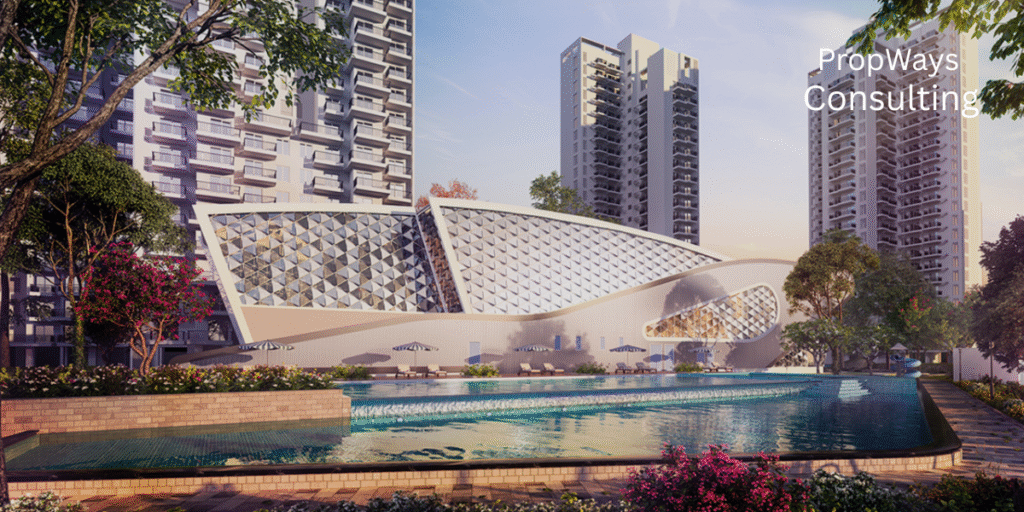

- Park or pool-facing apartments.

- Better vastu-compliant layouts.

Such options become limited once the project sells further.

4. Flexible Payment Plans

Builders often provide flexible installment options in pre-launch offers:

- Down payment-linked plans.

- Construction-linked plans.

- Subvention schemes (no EMI till possession).

This reduces financial pressure for homebuyers.

5. Exclusive Discounts & Add-Ons

Developers may include perks like:

- Waived club membership fees.

- Complimentary car parking.

- Free modular kitchen or interiors.

Such add-ons increase overall value.

6. Potential Rental Yields

For investors, these projects offer attractive rental opportunities post-possession, especially in high-demand cities like Gurgaon, Noida, and Bangalore. Early entry boosts ROI once the property is leased.

Risks to Consider in Pre-Launch Residential Properties

While there are clear benefits of investing in pre-launch residential properties, risks should not be ignored:

- Project Delays: Regulatory approvals or funding issues can cause delays.

- Builder Credibility: Choose developers with a strong track record.

- Market Fluctuations: Property appreciation depends on economic conditions.

Expert Tips for Safe Pre-Launch Investments

- Verify builder’s past projects and delivery record.

- Ensure RERA registration and approvals are in place.

- Review payment plans carefully before committing.

- Consult a real estate advisor or legal expert.

- Compare with nearby projects to assess pricing.

Comparison Table: Pre-Launch vs Post-Launch Investments

| Factor | Pre-Launch Properties | Post-Launch Properties |

|---|---|---|

| Price | Lower (10–30% cheaper) | Higher (market rates) |

| Unit Availability | Wide choice | Limited options |

| Appreciation Potential | High | Moderate |

| Risk Factor | Moderate (depends on builder) | Lower (ready approvals) |

| Payment Flexibility | More options | Standard plans only |

Future Outlook: Real Estate Investment in 2025

With rising urbanization, demand for modern housing, and favorable government policies, 2025 is shaping up to be a strong year for real estate. Benefits of Investing in Pre-Launch Residential Properties will remain attractive, especially in metro cities and fast-developing areas.

Upcoming infrastructure projects like metro expansions, expressways, and IT hubs will further boost property values.

Conclusion

The benefits of investing in pre-launch residential properties are clear—cost savings, higher appreciation, wider unit choices, and flexible payment plans. However, careful due diligence is essential to minimize risks.

For investors and homebuyers planning for 2025, pre-launch residential projects represent a smart strategy to secure prime homes at competitive rates and maximize long-term returns.